Welcome to The Merchant Life, for retailers and retail enthusiasts wanting the insider perspective of all things retail.

Now let’s talk shop.

In this week’s newsletter, we get excessive.

We talk about all things related to excess inventory – where it comes from, where it goes and how much it costs retailers.

In our insights, we talk about the emotional rush of getting into an exclusive, luxury warehouse sale.

It’s might be considered just a bit extra…

Let’s indulge in the excess.

Cause and Cost

To start, we covered overdevelopment in Volume 4 of our newsletter and we cited the estimated value of excess inventory.

To recap:

Women’s Wear Daily estimates that the value of excess inventory from Spring 2020 collections was between $160 billion and $180 billion globally. Much of the inventory is either heavily discounted to get that product out the door or sent to an off-price outlet, both options devaluing the brand.

Excess inventory has been reported to be destroyed – by means of burning, shredding or landfilling. In 2018, Burberry admitted to burning close to $37 million of excess goods in an effort to preserve its reputation of exclusivity. Other brands like Nike, Urban Outifitters and Victoria’s Secret have been called out for doing the same.

The overdevelopment of product is nothing new in the retail world and is simply accepted as BAU – Business as Usual.

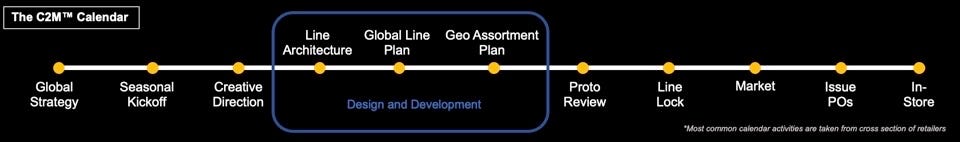

Also from Volume 4, we introduced this C2M Calendar, otherwise known as a line plan.

Retailers work through the details of what they want by style and the story they want to tell. Historically, this is completed approximately a year in advance of product hitting the shop floor.

Which is a significant period of time from end-to-end.

And a lot can happen in a year, re: COVID-19.

No matter the type of retailer, off-price, outlet, DTC or traditional, there will always be excess inventory at the end of the season.

Why?

Product forecasts are built in a manner analogous to throwing a dart at a dart board in the dark.

Both merchants and planners don’t have an accurate view of what is going to sell and by how much in a given season.

Much of the forecasting is arrived at using the previous year’s data – which itself overshot how much product was needed, which was based off the year before, which overshot how much product was needed and was based off….

You get the idea.

Also, forecasts are based on projected revenues. For example, if you are given a mandate of “increase revenue by 10% over last year” the buys tend to increase by the same amount. The catch here is that sales volume for the coming season may not match the previous season – for many reasons.

Again, a lot can happen in a year.

Less isn’t More. More is More.

…and “more” is expensive.

Raj (our loyalty expert) worked in a warehouse while in university and remembers a conversation with the manager, Rich Davis.

“Raj, look at all of these boxes.”

“Yeah, it’s great, all the shelves are loaded up with full skids.”

“Nope. It’s not great. If these shelves are this full, it’s a problem. Product isn’t moving. The last thing I want is cash tied up in all of this inventory.”

Rich is a smart guy. He understands that excess product is a problem and a costly one at that.

Not only does holding excess inventory affect liquidity as Rich referred to above, it forces a retailer to incur additional costs – insurance, freight, labour, and storage costs are examples. Moreover, the longer inventory is held, it depreciates in value and fetches a lower price in market as time ticks away.

A rough, back-of-the-envelope calculation might help here – let’s say those additional costs add up into an extra 30% in expenses that need to be covered. Let’s also say we have $1 million in inventory with 15% of it in excess.

Well, the value of the excess would be $150,000 and the 30% surcharge needed to handle that inventory comes to a total of $45,000.

In short, excess inventory impacts profits.

Holding goods that are not selling takes up space in your warehouse, increasing your operating costs.

Selling excess on markdown lowers your gross margin which eats into your profitability.

Ouch.

Shedding the Excess

For retailer to “ditch the fat” of excess inventory, there are ways to get rid of the product and still make a little profit.

First, they can promote and sell their excess inventory through markdowns or use of their own outlet stores (if they exist).

If those internal avenues fail to yield fruit, retailers can turn to external options.

First, they can offload the inventory to an off-price retailer like TJX, The Outnet, Burlington, TheRealReal, and so on. Off-price is poised to win big post-pandemic in part due to the glut of inventory available for them to source product from. COVID-19 cancelled orders, store closures, lockdown measures ➡️ off-price profits will be off the chart. In turn, they can offer a rich assortment to price-sensitive customers during the economic recovery.

The other alternative to off-price is liquidation using a 3rd party. Liquidators enable retailers to offload excess or aged inventory by hosting large sales events. They set up a warehouse space, hire the staff, promote the event and then take a percentage of total sales.

StyleDemocracy is an excess inventory solutions provider via outsourced warehouse and pop-up sale events. Their sales are famous, attracting crowds upwards of 50,000. They have run over 350 events across North America for brands like Nike, Adidas, Holt Renfrew, Hugo Boss, and more recently, The Bay.

We spoke to Oliver Berg, VP of StyleDemocracy, to talk ‘shop’.

Q: As an excess inventory solutions provider, how did the pandemic change your business model?

A: The pandemic changed our business pretty drastically. Not only we were a business based on physical shopping, but physical shopping on mass. A warehouse sale event with 5,000 people/day through our doors isn’t really that COVID friendly…After a couple of weeks into the pandemic, we realized that all of the events we had booked for that season were likely not going to happen and that we needed to pivot to eCommerce – and we did.

It took about a month for our team to figure out everything that was needed to make this switch. Not only did we need to figure out what was needed to do to get an online platform created, but we also needed to understand the logistics around working with other peoples inventory for eCommerce – receiving/uploading their digital assets, and the logistics around the movement of product. We’ve seen a ton of success and have a lot of exciting opportunities and partnerships in the works, but it would be foolish to assume our pivot was a smooth transition. We’ve definitely had our bumps in the road and have learned SO MUCH over the past year.

Q: Your business model requires retailers to have an excess inventory – what happens if retailers change the way they demand plan and this excess no longer exists?

A: Great question. From our experience, excess inventory will always exist but we understand that the pandemic has really changed the way all companies operate. We saw some clients cancel orders immediately leaving no excess available, but we’ve also seen other brands with major inventory challenges that need our assistance. What’s interesting about StyleDemocracy is that our B2B service of helping brands with inventory is fuelled by a B2C model we’ve developed over the years.

About 8 years ago, we strategically built a strong online presence around StyleDemoracy by leveraging our email database of shoppers and turning it into a high traffic, content-rich website with hundreds of thousands of monthly visitors whereby brands utilize our database and site traffic as a marketing platform. For example; when brands are hosting their own promotions either online, in stores, or both, they will advertise it on the SD platform – it’s an entirely separate revenue stream.

Q: What is the difference between you and an off-price retailer like Winners? What makes StyleDemocracy more attractive to a brand/retailer?

A: The difference between us and off-price liquidators is that we are a service provider/partner for brands. SD is not a multi-brand retailer with a permanent location. We run events for prominent brands and the brand is at the forefront versus seeing a multitude of brands on the same rack for weeks/months. For example, our events are branded as “The Adidas Warehouse Sale – powered by StyleDemocracy.”

We also provide a higher recovery for excess inventory than off-price liquidators as we are selling directly to the consumer. Furthermore, our clients get paid within a few days of the event, versus 60 days+.

Q: Let’s talk about circularity. How much product do you think you have saved from landfills in weight/dollars?

A: I’m not sure I can give the most accurate stat here with regards to weight/dollars, but what I can say is that in 2019 (our best year as a company) we sold roughly 400k units of inventory through our various events across North America at around 75% off retail recovery. The other options for that merchandise was either landfill or a discount retailer where the recovery would be less, the product would be sitting on the shelves for months, and the brand experience would be non-existent.

Unattainable Standards

The ideal scenario is buying what the customer wants by style, by size, and at the right quantity so that it is sold out in season at full price.

Like a mirage in the desert, this doesn’t exist.

But, our goal is success, not perfection.

The more productive path is to seek opportunities that go against the grain relative to how retailers are used to working.

Here are three approaches:

- Preventative Inventory PlanningPrevent excess inventory by using technology to predict the right product type, quantities, and sizes to offer customers.

- The (Inventory) Shell GameAllocate product from a poor selling store to a better selling store – customer demand is unpredictable and initial store allocations don’t always mirror reality of where goods sell best.

Shuffle product to meet demand.

- No Buys!Incorporate a pre-buy or made to measure model. Give customers the opportunity to order the product they want, in the colour and size they want; pay up front before the goods have been made and shipped.

This minimizes returns of unwanted goods that add to your excess inventory.

Not all approaches may be applicable nor is a single on a silver bullet. But, taking steps towards improved inventory planning is a good start.

RSG Insights – My Merchant Life

Like many of us, we make friends with our makeup and skincare sales representative. My strategic friendships were scattered across the city – at the Mac makeup counter The Bay, The Mac store in the Eaton Centre and on Bloor Street.

The end game?

A ticket to the Estée Lauder Mac Warehouse Sale.

#IYKYK

Then came the Hugo Boss VIP sale, the Club Monaco warehouse sale at Varsity Stadium, and the Hermes sale!

Hermes never had a sale. Ever.

Just like the Raptors never making the finals…the feeling was the same. Trying to get a seat at a table anywhere in a Toronto bar during the playoffs, toying with my emotions, it was complete madness!

The anticipation of getting the call at work, running out the door, pretending I suddenly had an all day appointment, 20 minutes to get to the Metro Convention Centre, 1000s of fashionistas in front of me.

Standing in line, in heels, for 3 hours.

Would we even get in? Was it all worth it? Would they even have any SCARVES?

Would I walk away with nothing???

The stress was real.

Fast forward to the summer of 2015 while working at RL in London. I had heard rumours that there was an epic Jimmy Choo sale and my team had never managed to score a ticket.

I was determined to change our luck. I had xmas gifts to buy!

We teamed up, contacted everyone we knew working in the industry to get the secret link to the coveted VIP sale…and we finally hit the jackpot.

Sort of…

We all signed up, hoping to get into the sale. Lo and behold, damn my love for fashion and luxury shoes, it was a lottery. So even if we were in, we were not IN!!! 😬

One by one, we received email confirmations. Not all of us were lucky enough to get into the sale but I made it – my life was complete! Just kidding.

It was total madness. And totally worth every Jimmy Choo shoe I have.

Luxury sample sales were the most coveted; the lottery system, hoping you get selected, seeing your friends get in and you are left out.

As retailers, we feed off that emotional rollercoaster (remember, emotion makes people buy).

Our RL sample sale was as epic as Jimmy Choo and Hermes. We didn’t have a lottery system but we had friends and family tickets to give out. Still coveted but sort of like the way I made ‘friends’ with the Mac artist. 🙄

Liquidation sales like the ones noted above will drive sales and help you clear out excess inventory, especially aged inventory.

But let’s be real – this still indicates that you bought way too much and did not plan the right skus/categories.