Welcome to The Merchant Life, for retailers and retail enthusiasts wanting the insider perspective of all things retail.

Now let’s talk shop.

In this week’s newsletter, we go incognito.

Covert.

Secretive.

Private, if you will.

This week, we discuss private label development, why you should do it, and how getting to know your customer can help you launch products with a following.

Let’s dive in on the reasons why private label development could be just what you need.

Private Mode

Let’s define private label.

For starters, it’s not actually private.

Private label is product that is sold under the brand name of the retailer.

From design to labelling and production and packaging, it is product that is manufactured by a 3rd party.

For you.

Grocery, beauty, and apparel have private brands across retailers. Trader Joe’s Dark Peanut Butter Cups or Costco’s Kirkland toilet paper are great examples of private brand products that have a loyal fan base.

Apparel private brands like Nordstrom’s Zella and BP (love their basic jersey dresses!) and Macy’s INC International Concepts and Style & Co are hitting the mark, feeding into consumer shifts in product category demands.

Beauty brands like Sephora and ULTA’S private label collections go head to head to with the top brands they carry.

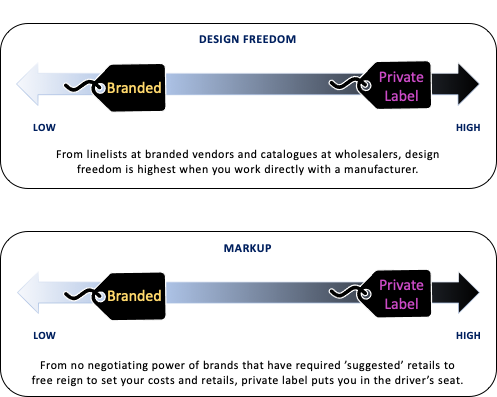

Private label has a few purposes but it really comes down to freedom and profitability.

The above summary is an indication of some pros and cons on having branded and private label in your assortment mix.

There is a huge opportunity to be had when you have the ability to add higher margin product to your assortment, directly impacting the bottom line.

Being a former merchant for stores such as SAAN, Sporting Life, and Caban/Club Monaco, adding private brands to the mix via wholesale agents like Li & Fung in addition to local and overseas manufacturers, helped me to get a balanced assortment.

The product mix consisted of about 70% brands and 30% private label.

The economics of private label are also quite favourable, consider that the margins I worked with were these ranges:

- Branded apparel = 52% to 58%

- Private brand via wholesaler = 65% to 70%

- Private brand via manufacturer = 75% to 85%

There is a sizeable jump in margin when moving from branded apparel to a private brand through a manufacturer.

Like patching up a hole in the wall, private label can fill up the wasted space with price point and product gaps that are created by branded collections.

This way, you can identify what is missing from a brand and fill it with a highly targeted, private label product.

So, if it’s profitable, why isn’t every retailer working in private mode?

Most don’t know where to start or have visibility into what tools are out there to help develop a program that is right for the retailer, to serve the customer in the best way.

One thing is clear.

Private label development starts with understanding what the customer wants in the first place.

Right on Target

Remembering the days when you spent hours in the stationary and craft section of your favourite Target, I mean Targé?

This was the first section I was in, while travelling to NYC for Ralph Lauren or when I was on a roadtrip to the US with my friends (remember those?!), I felt like a kid in a candy store.

Mondo Llama, Target’s new craft private brand, launched a few weeks ago and includes almost 400 arts and crafts products. Not only are the products on trend and in response to consumer behaviour during the pandemic (stay home and make the best of it), but it aligns with Target’s social responsibility and objectives.

This is how Target’s private brands become a slam dunk.

According to Target’s press page, the retailer incorporates ‘guest’ research and align their products to what is missing from their assortment.

This, it gives the customer the missing pieces from other brands.

“The design team was laser-focused on making Mondo Llama bright, bold — and inclusive. Case in point: a 24-shade skin tone color palette, found in Mondo Llama items like markers, crayons and paints, so all guests feel included and represented.

Tons of guest research and feedback impacted the final color palette and even the color names.”

Target not only asked their customers what they wanted but also commissioned a diverse set of artists across the globe to design the brand packaging.

They wanted their guests to feel included and represented. Imagine the emotional connection created with customers when these products are essentially created via crowdsourced feedback.

Using market research and data from the brands they are selling to develop a private brand that will delight their customers…genius.

While private brands allow a retailer to give their customers what they want by evaluating what is missing from market, the bottom line is what actually matters.

As per the March 2021 earnings call, CEO Brian Cornell talks about private brand profits:

“We cleared 2020 with 10 of our own brands each generating $1 billion or more and four of those crossed the $2 billion per year threshold. Any one of these brands alone would be a sizable retailer, and as you know, their contribution to profits is outsized.

Of course, owned and exclusive brands are just one component of our merchandising strategy, which has always drawn on curated national brands across our assortment.”

Having a merchandising strategy where branded products like Levi’s and ULTA drives customers to the store first, private label products will then help drive repeat visits.

Data Dive

Target has done a great job of crowdsourcing the customer point of view to fuel private label development.

Another approach is to dive deep into the customer data as a development strategy.

Case in point – Amazon.

Amazon is launching yet another private brand. Aplenty, a “clean” grocery assortment that includes hundreds of products sold across its digital and physical stores.

It’s not beyond me that leveraging the data from Whole Foods may have helped the retailer develop it’s assortment. The timing also couldn’t be better as Target ramps up the launch of Favorite Day.

Coincidence maybe?

Amazon Basics, in addition to 400 of its other private label brands, uses the data from independent users to develop competing products.

Although the online retail giant says they don’t take part in this tactic to gain market share or strong arm partners to offer up data like from voice-enabled devices even when customers weren’t using them, one thing is certain.

….well two things.

Amazon is ramping up it’s legal team.

AND

Amazon is great at developing private brands.

Digital Privacy

As the pandemic forced many restrictions across retail and travel, manufacturing and production ramped up their digital capabilities.

Traveling to trade shows, to visit agents, vendors, and factories in Bangladesh and China to find manufacturers to develop private label came to a grinding halt.

The alternative?

Design, development and manufacturing went digital. The upside being that vendors were gently nudged towards aligning with transparency and sustainability initiatives of retailers today.

Marketplaces like Bamboo Rose and FashionGo are examples of digital sourcing and sampling marketplaces that give new ways for buyers and suppliers to interact.

Paul Lee, from FashionGo told PYMTS this:

For the 1,400 brands or vendors and more than 756,000 registered retailers already on the FashionGo platform, it offered buyers and suppliers a more cost-effective and efficient way to get together and do business.

“From a time commitment standpoint there are only so many vendors and brands that you’re going to make appointments with [at a physical trade show],” said Lee. “But the virtual option can be, essentially, limitless in terms of the interactions to browse or procure merchandise.”

Swatchbook and Material-Exchange are more great examples of enabling technology to source digital ready materials from across the world.

Moral of this story?

Private brand development is accessible.

It is doable.

And as a retailer, if you are not thinking about getting your brand name on products in your stores then you are sadly missing out.