Welcome to The Merchant Life, for retailers and retail enthusiasts wanting the insider perspective of all things retail.

Now let’s talk shop.

We are a culture of consumption.

Retailers put a lot of product out into the world for consumers to consume.

And there is a problem of overdevelopment of products, especially in fashion.

In Volume Four of The Merchant Life, we talk about what overdevelopment is, what are the impacts to the industry and how the overdevelopment cycle can be broken.

Over The Overdevelopment

As a society, we buy too much.

As retailers, we produce too much.

From a fashion perspective, we tend to over develop and fall into the perpetual cycle of over production. In other words, we produce way more product than what is actually needed. This is one of the reasons why fast fashion is cited as being highly pollutive to the environment.

Not only is this detrimental a sustainability perspective, it is a waste of both time and money. The exact cost of overdevelopment is hard to pin down – values depend on the cost of production, shipping/storage fees and the costs associated with marking down excess inventory.

If we wanted to guesstimate, then consider the total retail value of excess inventory. Women’s Wear Daily estimates that the value of excess inventory from Spring 2020 collections was between $160 billion and $180 billion globally. Much of the inventory is either heavily discounted to get that product out the door or sent to an off-price outlet, both options devaluing the brand.

Worse, to avoid devaluation, excess inventory has been reported to be destroyed – by means of burning, shredding or landfilling. In 2018, Burberry admitted to burning close to $37 million of excess goods in an effort to preserve its reputation of exclusivity. Other brands like Nike, Urban Outifitters and Victoria’s Secret have been called out for doing the same.

Call us out for being crazy, but if you wanted to maintain a sense of exclusivity or scarcity…

MAKE LESS.

Like we said above, retailers enter the perpetual cycle of overdevelopment. Meaning that this repeats itself year after year, season after season and stretches the limit of echolalia.

The question becomes, how do we break the cycle? What are the causes of overdevelopment and how can we do better?

Planning to Fail

More often than not, retailers start the season with a calendar – where they plan their season from strategy to store.

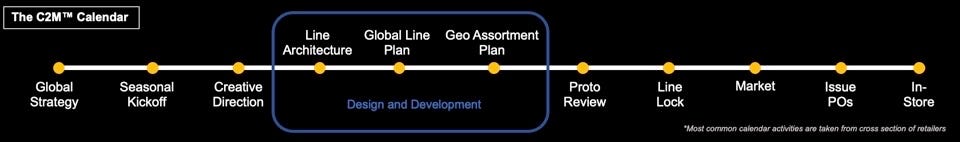

We outline the calendar below in our Concept-2-Market™ timeline.

Retailers work through the details of what they want by style and what story they want to tell. In this process, each point on the calendar has to be mapped out and approved before the collection goes into production.

The calendar serves as the retailer’s GPS.

All this is mapped out at least a year in advance of collections hitting the shop floor.

Let’s zoom into the “Design and Development” part of the calendar:

“Line Architecture” is an industry term for the framework of the season – this consists of specifics such as the number of categories to be bought, how many sku’s per category, quantities of a style and colour etc. These numbers are driven by margins, profitability, historical sales data and qualitative feedback from the marketplace. The framework then feeds into the “Global Line Plan” and then further scoped in the “Geo Assortment Plan.”

Whether you are a design-lead or a merchant-lead retailer, planning on how deep to invest in these categories is driven by minimum order quantities. Product development and sourcing will work with factory partners to minimize risk by ordering enough fabric and materials upfront to keep costs low and margins high.

Factories require a minimum if you want to place an order and retailers need to place the ‘right’ quantity in order to get the ‘right’ price.

So you tend to buy.

A LOT.

This overbuying activity and overproduction of product is planned for, year after year.

The biggest challenge we have as retailers is to understand what to buy and how much to buy, within the boundaries of minimum order quantities.

When I was a buyer for a global luxury brand, my hands were tied by minimum order quantities. It wasn’t much different when I worked for a department store. The planner utilized top down planning and told me what categories and # of sku’s would work best for the season based on sales history and store capacity.

The assumption was always the same, if people liked something last season, we will sell more of it the following season.

Remember, this planning for the season needs to happen a year in advance. If consumer habits suddenly shift (e.g.) a global pandemic or there was no snow in the winter, then a retailer becomes stuck with an irrelevant product line and merch that doesn’t move.

Others in the industry are aware of this issue. According to Luisa Herrera-Garcia, SVP of Production at John Varvatos, in an interview with the Sourcing Journal:

“The days of having to buy large quantities are over. We need to be smarter and be quick to adapt to change.”

We spoke to Lindita Xhaferi-Salihu of the Sector Engagement Lead for the UN Fashion Industry Charter for Climate Change (UNFCCC), and she says it’s about the system and it has to change.

“The fact is the fashion industry does not need to grow. There is no reason for the industry to grow. But many companies are still hiring growth officers. Growth is in the mindset until regulations become available that make it really difficult for companies to continue to grow.

We are at that moment where it is becoming more difficult for the fashion industry to continue to do what it’s doing. We are trying to address that by working with consumers somehow so they can put pressure on the industry.”

Consumers are getting more educated and it is a good moment for the industry to reevaluate their business models – think about “degrowth” and making less.

We are on the right track, the commitment is there but we still have a long way to go. The question is how can we get everyone to do their part – engage all parts of the society in this conversation.

Doing Better

Having reflected on this issue, I engaged in a thought experiment and asked myself: If I could my job over again, what would I do differently to avoid over buying?

Here’s what I came up with –

Focus on Partnerships:

- Optimize my vendor base and build better relationships with my best partners.

- With better relationships in place, push for a reduction in minimum order quantities.

Optimize Assortments with Seasonless and Innovative Products:

- Increase seasonless product assortment by transcending traditional seasonal collection. Refocus on styles that can last beyond traditional seasons.

- Deliberately leave room in the line plan for in-season and innovative development, allowing for reaction to what customers want in real-time.

Get Closer to the Customer:

- Test product before production by implementing customer validation throughout the product creation process.

- Invest in retail technology tools to enable predictive analytics, AI, and machine learning to help make better buying decisions.

The Pendulum Swings Back

If retailers have been in a state of overdevelopment for an extended period of time, eventually there will need to be a shift in the other direction.

We see three ways that both retailers and consumers can influence overproduction:

- Circularity

- Pre-Order / Made-To-Order

- Reselling

Circularity:

The circular economy in fashion is making its way through our industry propelled by the consumer demand for sustainability.

Levi’s, Patagonia, Nike, and even Ikea are using discarded materials to make new products. This is a great way to reduce new material development and the impact of raw material production to the environment.

The caveat here is there is an element of production that exist here. Sustainability advocates would exert caution and remind us that we want to find ways to reduce environmental impact and not just shift where the impact originates from.

Pre-Order/Made-To-Order:

Remember walking into your favourite department store and sitting down for a trunk show, seeing a runway collection, meeting the designer, and pre-ordering what you wanted in your size? Moda Operandi has doubled down its virtual trunk shows and modernizing the way we shop by going back to basics.

The concept is simple enough: pre-ordering and capping orders at a specific number eliminates overproduction. Hold little to no inventory and sell at full price.

Pre-ordering is not only for the luxury market. The sustainable loungewear brand, Pangaia, is making waves and showing that consumers are willing to wait for the items that they want.

Reselling

Maybe the best level of production is no production at all.

As Lindita remarks “My kids are Gen-Z. My kids don’t care about buying shiny new clothing, they are into resale and vintage items. So, it will be interesting to see how things play out.”

The resale market in fashion is no longer relegated to Value Village and vintage stores. The secondhand apparel market is valued at about $28 billion today and is forecasted to reach $64 billion within the five years, according to a new report by ThredUp and GlobalData Retail.

“Younger people are getting smarter than ever about how wasteful [fast fashion] is,” James Reinhart, CEO of ThredUp, said in a CNBC article. “For years, I was trying to convince retailers to care about this.”

Familiar names like Wal-Mart and Gucci have partnered with resale marketplaces like ThredUp and The RealReal respectively. Thrift is not being hidden in the back of the closet anymore as consumers wear their re-sale goods with pride.

Breaking The Habit

They say our days make up our lives and habits make up our days.

Overdevelopment has become habitual as a direct result of increased consumer overconsumption. However, the emerging trends of resale, circularity and sustainability will force a change in these habits.

Deeply fortified processes in industry are usually the triumph of the means over the end. Such processes need time to be dismantled and for newer, more efficient ones to replace them.

Of course, there needs to be a driver of change to push through.

We could go on ad nauseum about the effects of wasteful production on the environment.

But the bottom line is that being wasteful hurts the bottom line.

We discuss further in our Insights section below, how overdevelopment can be tackled by managing materials during line planning.

RSG Insights – Materials Management

In working with a global $40B apparel and footwear company, we identified opportunities to manage material development and reduce the silos of development requests across gender, categories, and styles.

First, let’s define what is a Material:

A material consists of the building blocks for a product – from a textile to a print to a zipper or button to colour and more. It’s the make-up of your item.

Much of our work was focused on the overdevelopment of materials like textiles, trims, prints, and colours across categories – every single season.

Overdeveloped materials were put aside and the next season you went through the same process – product design requests a material, it is developed, a physical sample is approved, design would reject it and want something else.

Further, these teams come together at major moments in the retail calendar yet those teams work in isolation from one another.

The cycle was the same and impacted the business the following way:

- Similar designs were being developed across categories, efforts were being unnecessarily duplicated.

- Many new developments were not adopted and used in the final production of a garment.

It was wasteful and inefficient.

To alleviate the impact, it is essential that teams work together at the start of the season.

Cross-functional teams across categories can work together, collaborating to determine material selection upfront, avoiding delays during design finalization, and best of all, removing redundant development.

Here are specific tips to help in this process.

- Strategize – Give materials teams visibility when building your season and avoid design disappointment due to inadequate material selection.

- Partner – Encourage the use of approved and already developed materials to avoid overdevelopment; this is accomplished by partnering with design teams.

- Digitize – Reduce excessive communication, manual file transfers, and physical sample back and forth with overseas sourcing + production teams by working in one digital file.

- Document – Develop a library of physical and digital approved materials that can be referenced on demand.

Although we can’t divulge specifics, material overdevelopment was reduced by more than 50% when teams worked together at the start of the season.

Naturally, this translates into cost savings and effort allocated towards the most productive tasks instead of being engaged in redundant effort.