Welcome to The Merchant Life, for retailers and retail enthusiasts seeking the insider perspective of all things retail.

Fun fact, I was an off-price merchant back in 2006 and looking at the state of off-price today, it’s pretty clear that this channel is hotter than ever.

Off-price retailers are buying every single day: looking for deals, excess inventory and the best brands (at the best prices) for their customers.

Now, depending on your point of view, the off-price world can be viewed very differently.

- From a shoppers perspective, off-price is a treasure hunt where newness can be found on the daily.

- From an industry perspective, off-price can be seen as shady and the idea of closeouts often makes full-price buyers cringe.

What I’m proposing here is to shift how the industry views off-price.

Imagine if the narrative regarding off-price changes to something like this:

- A sustainable and circular retail model for the product journey

- A solution to excess and aged inventory

- An in-season opportunity to react to customer buying shifts

Let’s dive in.

Industry Overview…Offloading Off-Price

Retailers have been making headlines for the past 2 years.

Brands going bankrupt, retailers splitting digital and physical businesses to access cash, brands like Nike shifting to a DTC strategy and altering the traditional wholesale model, etc.

We have the well documented roller coaster ride of digitally native superstars like Warby Parker, Allbirds and Glossier – showing declining results and VC’s looking for more evidence of profitability in the DTC brands they look to invest in.

In contrast, the off-price segment is B O O M I N G.

On fire.

“Lit” as the kids would say. 🔥

According to Modern Retail, off-price is ‘thriving amid economic uncertainty”. As many retailers grapple with the well-publicized issues in the supply chain or factory delays resulting in products arriving late, the off-price industry is making bank.

In fact, “Ross’s fourth-quarter sales were $5 billion, with comp sales up 9% compared to the same period in 2019. TJX’s net sales were up 14% to $13.9 billion in the fourth quarter from two years ago. Burlington’s total sales increased 18% in the fourth quarter from two years ago, and comp sales were up 6%.” (source: Modern Retail)

With this in mind, let’s examine how we can change the off-price narrative.

1 – OffPrice as a Sustainability Solution

The idea of rethinking this retail vertical took hold, so we flew down to Vegas in February to attend the OFFPRICE Show.

Inspired by the event and vendors that keep coming back year after year, I’ve decided to take it upon myself to change how we look at this industry…for good.

First, sustainability.

We spoke with former TJX buyer, Jennisa Visram, on her thoughts as an internal player in the off-price world.

“Off-Price retailers have saved billions of dollars of goods from going to landfills, being destroyed or discarded, creating another channel of the circular economy.“

The sustainability message is embedded into the merchants mantra.

The Business of Fashion featured a report from the Changing Markets Foundation which opened a can of worms on sustainability and the fashion industry using it as a simple marketing ploy.

While regulations around sustainability are pending, questions are being raised as to how quickly such regulations can have an impact. Demanding that retailers change the way they make products and also the amount that is made won’t take hold in short order.

As a result, rethinking the lifecycle of a product can be more rapidly impactful.

Circularity initiatives like that of Lululemon, Levi’s and Nike allows customers to return used product, then repurposing into new goods.

“With customer demands evolving to include sustainability and transparency, these facets of production will become vital parts of product procurement.

With large brand houses committing to increased social responsibility practices, a natural trickle down effect will happen for the off-price industry as well.”, says Visram.

Customers want to align with brands that are making a difference and off-price retailers are cashing in.

Resale is no different.

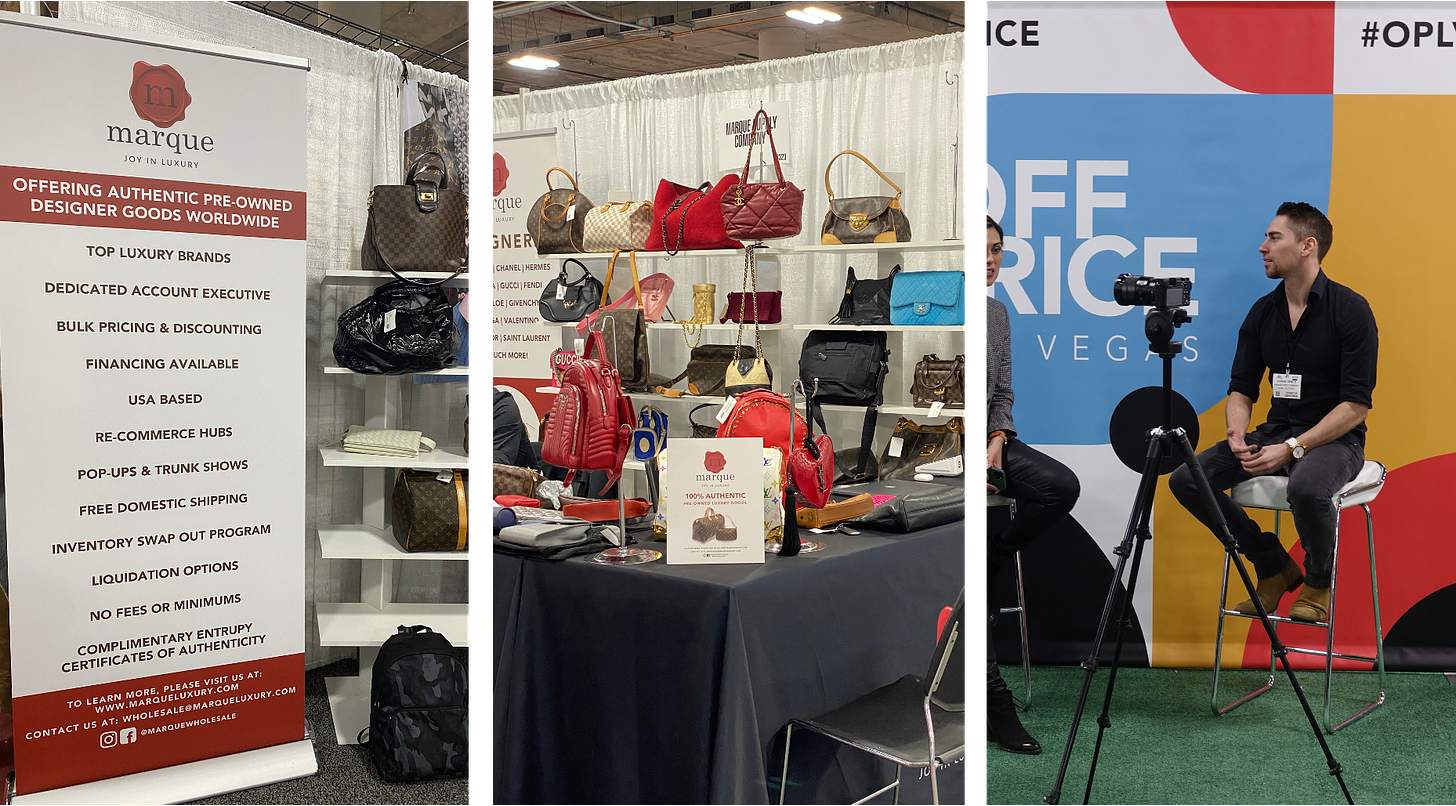

Secondhand platforms like thredUP and The RealReal are changing the way consumers shop, extending the life of product. Luxury resale has taken on new life and vendors such as Marque are offering wholesale to many retailers that are looking to capitalize on the shift to pre-loved products.

Chase Vance, of Marque Luxury, says buyers are coming in troves and there is not enough stock to go around. Expanding in all parts of North America with warehouses across the country, resale luxury is booming.

And OFFPRICE has it all.

2 – Ditching Excess Inventory

Supply chain chaos caused a stir and empty shelves were inevitable this past holiday season. Goods were late or didn’t arrive at all.

Now, retailers and brands are sitting on inventory that is seasonal and is unable to be sold.

Brandon Rael, once a merchant for Ross stores and currently working with Capgemini Invent as the Strategy & Operations Lead, sees off-price as a solution for brands.

“This segment of retail has served as a viable outlet for the full price sector’s excess inventory, due to overbuys, cancellations, and items that were not successful on the sales floor.”

Christmas cozy fleece sets and slippers have no place in stores today. So, what happens to the excess?

Well, once the promotional cadence has been exhausted and returned stock has not moved, it just sits there.

Idle. Collecting dust.

Until it doesn’t.

Unwanted excess is sent to landfills, found on ocean floors or sent offshore to countries like Ghana and Chile.

Discarded product is making headlines.

The headlines inform consumers who then start to hold retail culprits accountable.

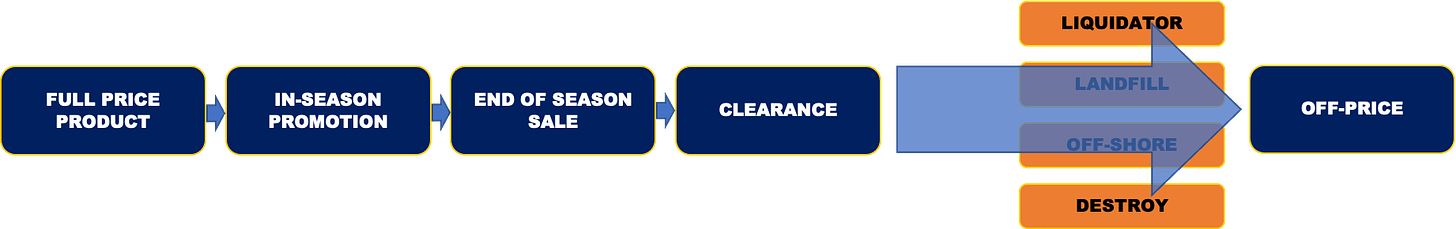

If we want to map out the product journey, it would look like this:

When product hits the finish line and ends up either destroyed or in the landfill, it adds to pollution and devalues the brand.

Clearly a losing proposition.

If we incorporate an off-price channel in the seasonal product lifecycle, then we have this:

Off-price now becomes a solution for excess, aged, and out of season inventory.

There’s a reason Macy’s is planning to open 37 Backstage shop-in-shops in their full-price stores. RetailWire reported that “Macy’s looked to tap into strong growth being seen across the off-price channel. Macy’s by early 2019 was indicating that adding Backstage in an existing store was providing more than a five-percentage-point sales lift on average.”

The beauty of all this? Macy’s can send their end of season merchandise to their own off-price channel and cash in on the booming trend.

We met with Miguel Vivanco of SMASH Clothing and he told us that buyers have been meeting with him at the OFFPRICE show for the last 20 years.

Specializing in quality and affordable menswear that can be delivered in a week or customized private label apparel that could be delivered in a matter of 1 – 2 months! As a merchant used to a 52 week concept-to-market calendar, this is wild to me. 😮

Miguel, like many others at the show, realized there was a huge opportunity in giving retailers the option to capture in-season sales that you couldn’t do with traditional long-lead time vendors. Miguel started to see buyers flow into the OFFPRICE show after walking through the other major trade shows during market asking for customized private label for immediate ship.

Reacting to shifts in trends became the secret to his success.

3) In-Season Planning Solution

Imagine if we actually did free up more OTB to buy closer to the season and have the ability to immediately shift into products that customers are looking for.

This is not a new concept. In fact, we talked about saving our planners by increasing in-season planning and buying closer to market in great detail in Volume 25 of The Merchant Life.

Why does this model work?

- Deals are abundant. Retailers are always looking to get out of inventory for a multitude of reasons.

- Disruption is constant. Blame COVID, cotton bans, ships stuck in the Suez or the supply chain “crisis.”

- Get what the customer wants. A weekly OTB gives buyers/planners the ability to follow the deals.

The off-price model is highly flexible because of the ability to plan and buy in-season.

We met with Brandon of D&L Apparel, the go-to vendor for branded sportswear and denim for men, women and kids.

Merchants were lined up to visit the booth, taking advantage of in-season trends and opportunities to spend open to buy.

That’s right.

Lined up.

The moral of this story:

Off-price is not just a consumer treasure hunt, it’s good business strategy for retailers.

The Off-Price Shift

Reimagining the off-price channel as a sustainable solution for brands and retailers, as part of the product journey and as a way to react to customers in season is just the tip of the iceberg.

Sourcing materials to products, chasing trends, and saving margins through the off-price channel will help retailers shift ways of working and planning assortments while keeping customers shopping.

Leaving you with this short teaser of February’s OFFPRICE Show:

We know you can’t wait to attend the next one!

RSG Highlights:

In timely fashion, I was featured on RetailWire for my thoughts on Macy’s Backstage moves.

“Off-price should be a part of retailers’ product strategy. It’s a sustainable way to offload excess and keeping it in the family like Macy’s and The Rack, with the right vendor strategy, is a win.”

Read more on how off-price is where consumers are planning on spending to offset today’s inflation: LINK

ShopTalk

We were back in sin city this week for ShopTalk 2022 and what happened in Vegas was posted on social.

Highlights:

🎙️ Talked shop – thanks to Salesforce and Microsoft in partnership with RETHINK Retail for having me on your shows!

📺 Reported live from the show with RetailWire and my friend, Ricardo Belmar: Replay

🐦 Blew up my twitter with live action.

🥳 Met so many friends, clients, colleagues and the RETHINK Retail Influencers IRL!

Next Up: Retail Innovation Conference & Expo

I’ll be in discussion with Target EVP, Chief Food & Beverage Officer, Rick Gomez.

We will dig into Target’s investment in fulfillment innovation, merchandise planning and their strategy to provide customers with a diverse product assortment.

The Retail Innovation Conference & Expo will be held in May, featuring speakers from Abercrombie and Fitch, Aerie, M&Ms, Popeyes, Francesca’s, FRYE, e.l.f. beauty, eBay, Google and Meta!

✔️Get your all access pass (with my 50% discount code) immediately. This conference is not to be missed: RICE50P07

📺 The Retail Thought Leader Roundtable is LIVE!

Streaming now with Jasmine Glasheen, RetailWire’s George Anderson, Christine Russo and Chain Store Age’s Dan Berthiaume ➡️ Replay